Fractal Analytics: India's First AI IPO Faces the Reality Test

Turning data into decisions, Fractal bets its AI + Engineering + Design edge will outlast the giants.

Welcome to Episode 18 of Next in Line by Infinyte - a data-first, investor-focused series where we unpack India’s most exciting IPO-bound companies with crisp, data-backed drops.

It’s everything you need to stay one step ahead of the bell-no fluff, no noise, just smart, visual storytelling.

Because the best stories don’t start at the IPO-they start just before it.

Stay tuned, stay curious!

Episode 18: India’s Quiet AI Disruptor Steps Into the Spotlight

Imagine you're the marketing head of a Fortune 500 retail chain. Black Friday Sale is approaching, and you need to optimize pricing across 50,000 units in real-time, predict demand surges by geography, and manage inventory without leaving money on the table. Traditional consultants would take months to analyze your data and charge millions for generic recommendations.

This is exactly one of the problem’s Fractal Analytics was built to solve along with customer analytics, risk management, demand forecasting, competitive trend analysis, healthcare detection and provide end-to-end AI implementation.

Fractal started as a bet that data intelligence could transform how businesses make decisions. It is about to become India's first pure-play AI company to go public with a ₹4,900 crore DRHP filed in August 2025.

Fractal's Bet: The Fragmentation Specialist

Accenture commanded global reach and enterprise relationships. McKinsey extracted premium rates for strategic advice. IBM pushed Watson into every conceivable use case. Deloitte built armies of generalist consultants. The logic was ironclad: enterprise AI needed massive consulting teams, expensive infrastructure, and decades of Fortune 500 trust.

If you were a mid-sized company or regional player, your choices were bleak. The system wasn't built for nuanced, industry-specific AI implementations. Then something unexpected happened. The market didn't consolidate around the giants, it fragmented around specialization. Fractal builds custom AI engines that automate your most complex business decisions, serving major tech companies including Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta and Tesla.

Think of it as renting a team of data scientists, AI engineers, and business strategists who never sleep, never quit, and get smarter every quarter.

For a healthcare company: Fractal's Qure.ai platform can analyze millions of medical scans, detecting conditions like tuberculosis or brain hemorrhages faster and more accurately than human radiologists.

For a retail giant: Their Asper.ai platform continuously optimizes pricing across thousands of products, predicting demand patterns, competitor moves, and market shifts in real-time.

For a financial services firm: Fractal builds AI models that assess credit risk, detect fraud, and personalize customer experiences at scale, processing millions of transactions while learning and adapting continuously.

The difference? While most AI companies sell tools, Fractal sells outcomes. Their clients don't just get AI software, they get measurable business results backed by sophisticated algorithms custom-built for their industry.

The Secret Sauce: AI + Engineering + Design

Here's where Fractal gets genuinely interesting. While competitors focus on either analytics OR consulting OR technology, Fractal combines all three with something they call "AI + Engineering + Design."

Consulting firms excel at strategy but struggle with implementation

Tech companies build powerful tools but miss business context

Analytics firms crunch numbers but can't operationalize insights

Fractal does all three simultaneously. They understand your business problem (consulting), build custom AI solutions (engineering), and make them intuitive for your teams to use (design). That integration is harder to replicate than it sounds.

The proof is in their patent portfolio: over 100 proprietary algorithms for everything from automated data integration to advanced object recognition.

The Moats That Actually Matter

Along with holy trinity of AI + Engineering + Design, Fractal’s moats lie in:

Deep Industry Expertise: Twenty-five years of building sector-specific knowledge isn't something competitors can replicate overnight. Fractal knows how healthcare analytics differs from retail optimization, how financial services risk models behave differently than manufacturing efficiency algorithms. That specialization still commands premium pricing when clients desperately need it.

Fortune 500 Embedded Relationships: Once you're built into a company's decision-making infrastructure, switching costs become very real. When Fractal's algorithms are automatically adjusting pricing strategies or supply chain decisions that affect billions in revenue, replacing them isn't just expensive—it's operationally risky. Their 250+ client base represents genuine competitive advantage.

Trust Is the Ultimate Moat: When you're helping Fortune 500 companies make billion-dollar decisions based on AI recommendations, even minor errors feel catastrophic. The moat isn't technology, it's trust built through consistent results.

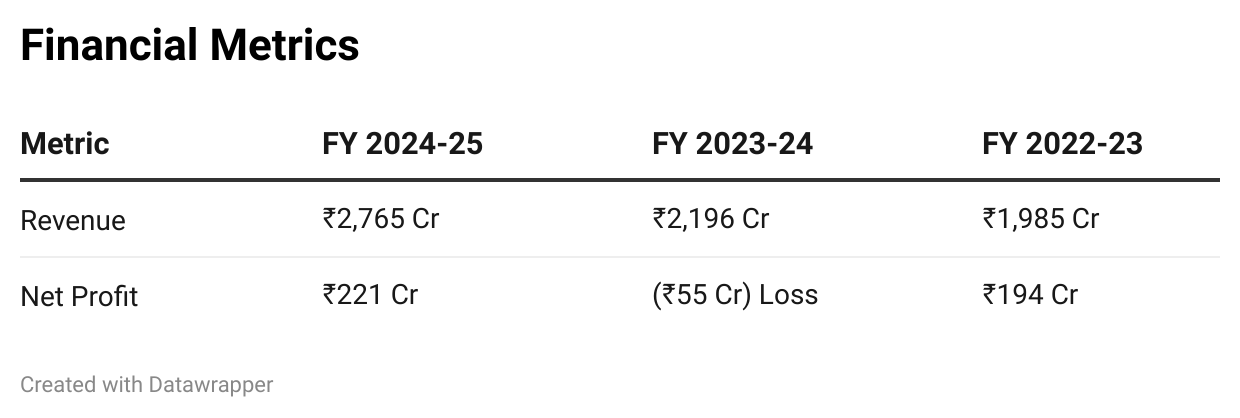

What do the numbers reveal?

The trend reflects a temporary dip in FY 2023-24 followed by a recovery and improvement in FY 2024-25, however profitability is prone to risk by the following:

The US Market Freeze: Two-thirds of Fractal's revenue comes from America, where rising interest rates killed the easy money that funded experimental AI projects. Corporate spending shifted overnight from "nice to have" AI innovations to "must have" cost optimization. Fractal found itself selling premium solutions in a suddenly price-sensitive market.

The Consulting Cliff: Enterprise AI reached an unexpected inflection point. Early adopters had implemented their first wave of AI solutions. The easy wins were captured. What remained were complex, long-term transformations requiring different expertise and deeper organizational integration, exactly the kind of projects that get delayed when budgets tighten.

The Real Questions That Matter

Can Fractal maintain technical leadership as Google, Microsoft, and Amazon pour tens of billions into enterprise AI?

Most critically: Can it scale its "AI + Engineering + Design" integration without becoming the generic AI vendor its clients originally came to it to avoid?

The Investment Paradox: Fractal offers unique exposure to India's AI growth story with proven enterprise relationships, but faces the classic consulting firm challenge of scaling specialized expertise without losing differentiation.

The next 18 months will determine whether India's first AI unicorn can prove that being smart, focused, and client-obsessed beats being big, well-funded, and platform-heavy.

Because the real disruption in enterprise AI isn't happening through billion-dollar research labs or flashy product launches. Sometimes the most profound changes happen quietly, one algorithm at a time, in the unglamorous work of making businesses measurably smarter.

And that's exactly the kind of disruption Fractal Analytics was built to deliver, if it can navigate the public market reality test.